The Ultimate Diet Guide

Expert tips and advice for achieving your health and fitness goals.

Disability Insurance: Your Secret Safeguard Against Uncertainty

Discover how disability insurance can be your ultimate safety net in uncertain times. Protect your income and peace of mind today!

Understanding Disability Insurance: How It Protects Your Income

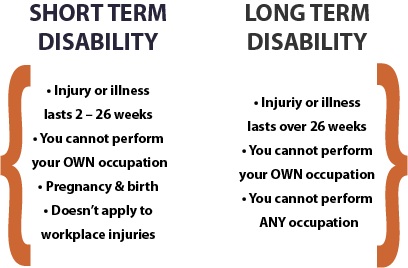

Disability insurance is a crucial financial safety net designed to protect your income in the event that you become unable to work due to a debilitating illness or injury. Unlike health insurance, which covers medical costs, disability insurance provides you with a percentage of your salary, ensuring you can meet your living expenses even when your ability to work is compromised. This type of coverage typically falls into two categories: short-term and long-term disability insurance, each tailored to meet different needs and circumstances. Understanding these options is essential in selecting the right policy that aligns with your financial situation.

Should you find yourself in a position where you cannot work, the benefits of disability insurance become immediately apparent. The income replacement can help you maintain your standard of living, cover monthly bills, and provide for your family during difficult times. In addition to individual policies, employers often offer group disability insurance as part of their benefits package. It's important to evaluate the terms and conditions of these policies, including waiting periods, benefit durations, and coverage limitations, to ensure you are adequately protected against life's uncertainties.

Top 5 Myths About Disability Insurance Debunked

Disability insurance is surrounded by various misconceptions that can lead to poor financial decisions. One of the most common myths is that disability insurance is only for those in high-risk professions. In reality, accidents and illnesses can affect anyone at any time, regardless of their job. According to recent studies, nearly one in four individuals will experience a disability at some point in their working life. Therefore, not having insurance is a risky gamble for engineers, teachers, and office workers alike.

Another prevalent myth is that disability insurance covers all forms of disability. In truth, most policies have specific criteria and conditions that must be met before benefits are paid out. It's essential to read the fine print and understand the terms of your policy, as many plans exclude coverage for certain pre-existing conditions or require that the disability be categorized as 'total' rather than 'partial.' This misunderstanding can lead to dissatisfaction and financial strain when a claim is denied.

Is Disability Insurance Worth It? Here’s What You Need to Know

When considering whether disability insurance is worth it, it's important to assess your financial situation and the risks you face. This type of insurance provides income replacement if you're unable to work due to illness or injury, offering crucial financial stability. According to estimates, about 1 in 4 individuals will experience a disability before reaching retirement age, making the need for protection more apparent. By investing in disability insurance, you ensure that you have a safety net that can cover living expenses like rent or mortgage, utilities, and groceries during a challenging time.

There are two primary types of disability insurance: short-term and long-term. Short-term plans typically cover a portion of your income for a limited period, usually between three to six months, while long-term policies can provide benefits for several years or even until retirement age. It’s essential to carefully evaluate your needs: consider your savings, existing expenses, and how long you could manage without a paycheck. Ultimately, the peace of mind that comes with having disability insurance can outweigh the costs, making it a valuable consideration for anyone concerned about their ability to earn an income.