The Ultimate Diet Guide

Expert tips and advice for achieving your health and fitness goals.

Is Life Insurance Really Worth It? Let's Break It Down!

Discover the truth behind life insurance! Uncover the pros and cons to see if it's really worth your investment. Click to find out!

Understanding the True Value of Life Insurance: What You Need to Know

Life insurance is often viewed as a financial safety net, providing peace of mind in times of uncertainty. However, the true value of life insurance goes beyond just protection; it serves as a vital part of a comprehensive financial strategy. According to the Investopedia, life insurance can help cover living expenses, debt obligations, and even future education costs for your dependents, ensuring their financial stability should the unexpected occur. By understanding the various types of policies available, such as term and whole life insurance, individuals can tailor their coverage to meet their unique needs and goals.

Moreover, life insurance can provide significant tax advantages, making it a valuable asset in wealth planning. For instance, the death benefit is generally paid out tax-free to beneficiaries, which offers peace of mind that loved ones will receive the full intended amount without the burden of taxes. Additionally, certain policies accumulate cash value that can be accessed through loans or withdrawals, offering a potential source of funds during your lifetime. To learn more about the financial benefits and flexibility of life insurance, consider resources from NAHU.

Is Life Insurance a Smart Investment? Pros and Cons Explained

When considering whether life insurance is a smart investment, it's important to weigh both the pros and cons. One of the key advantages is that life insurance provides financial security for your loved ones in the event of your unexpected passing. This can help cover expenses such as mortgage payments, children's education, and other debts. Additionally, some types of life insurance policies, like whole life or universal life, accumulate cash value over time, which can serve as a living benefit during your lifetime. For a detailed breakdown of different types of life insurance, you can visit Investopedia.

On the flip side, there are drawbacks to consider. One significant con is the cost associated with premiums, which can be substantial, especially for whole life policies. Many people also find the terms and conditions of these policies complex, making it easy to feel overwhelmed when selecting the right coverage. Furthermore, if you do not outlive the policy's guaranteed period, your investment may not yield any direct financial benefit. For a comprehensive look at the challenges of life insurance, read more at NerdWallet.

Life Insurance Myths Debunked: What Everyone Should Know Before Buying

When considering life insurance, many people are influenced by prevalent myths that can lead to poor financial decisions. One common myth is that life insurance is too expensive for the average person. In reality, there are various types of policies, including term life insurance, which can be very affordable. The National Association of Insurance Commissioners reports that many individuals underestimate the affordability of life insurance, as premiums can be lower than the cost of a monthly coffee habit.

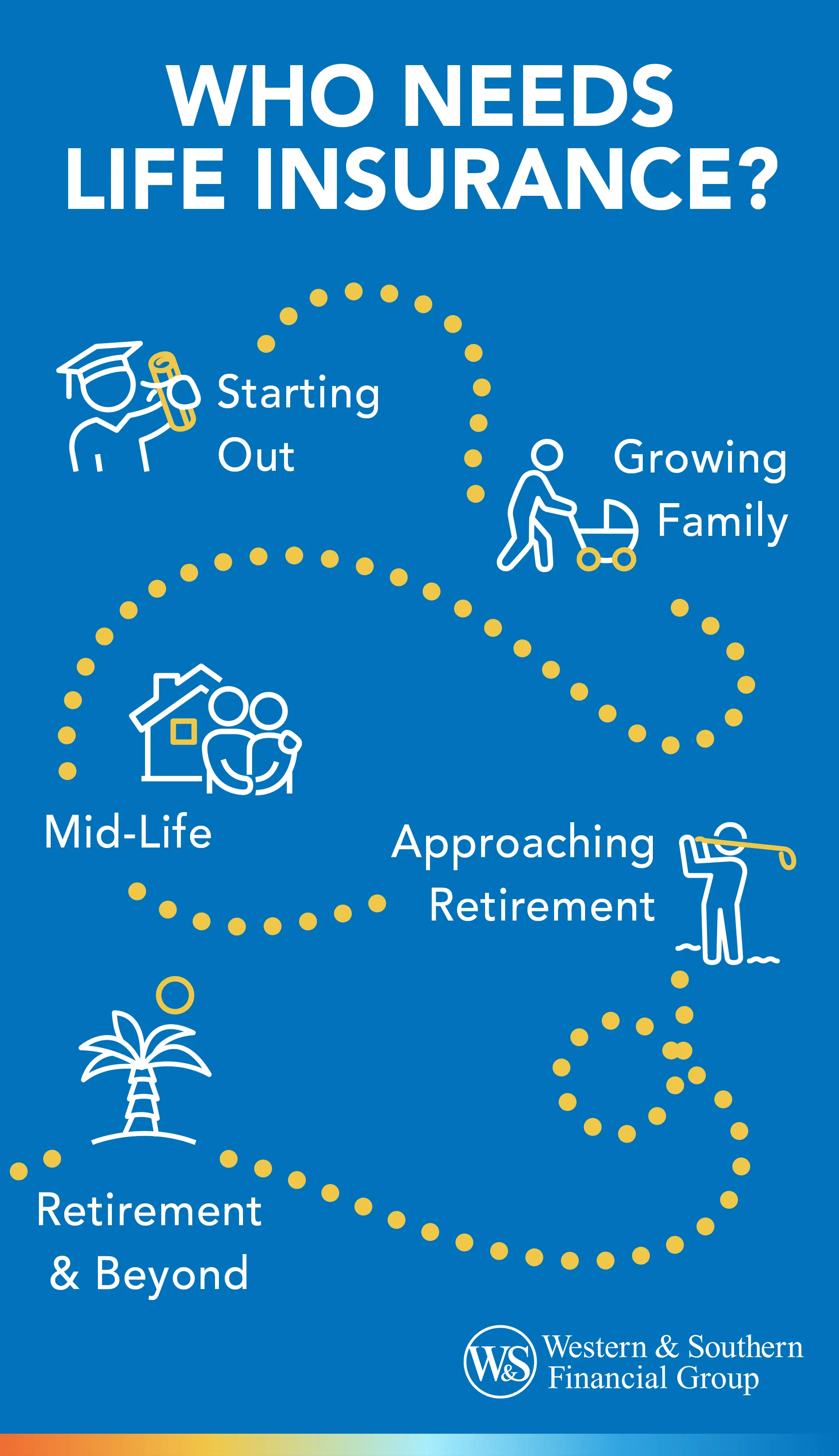

Another misconception is that only individuals with dependents need life insurance. In truth, anyone can benefit from a policy, especially if they have debt or want to cover final expenses. As highlighted by the Insurance Information Institute, millennials and single individuals may think they're not a priority for coverage, but securing a policy early can lead to lower premiums and added financial security in the future.