The Ultimate Diet Guide

Expert tips and advice for achieving your health and fitness goals.

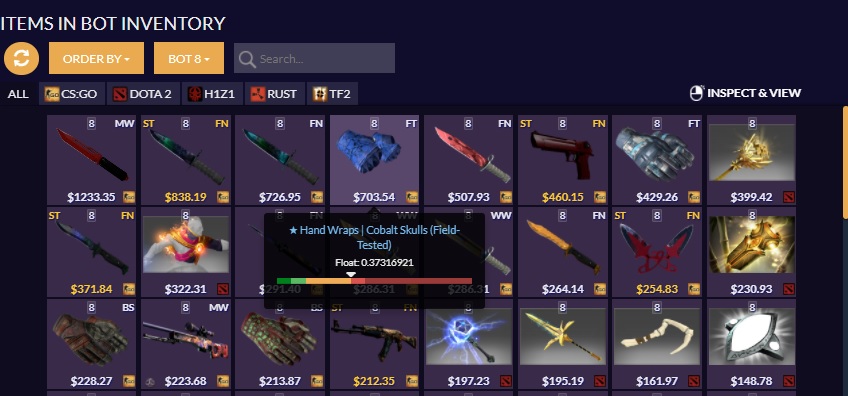

Trade Bots: Your New Best Friend or Just Digital Foes?

Discover if trade bots are your ultimate ally in the market or digital foes to beware. Uncover the truth now!

How Do Trade Bots Work? A Comprehensive Guide

Trade bots are automated software applications designed to execute trading strategies on behalf of traders in various markets, including stocks, forex, and cryptocurrencies. They leverage algorithms to analyze market trends and make rapid decisions based on pre-defined rules. Typically, these bots can operate continuously without the need for human intervention, allowing them to capitalize on trading opportunities at any time of day. The primary advantage of using a trade bot is its ability to process large volumes of data swiftly, identifying potential buy or sell signals that might be overlooked by a human trader.

In essence, trade bots work through a set of algorithms that evaluate multiple market indicators to make informed decisions. The process usually involves:

- Data collection: Gathering real-time data from various market sources.

- Signal generation: Using technical analysis to identify trading opportunities.

- Execution: Automatically placing buy or sell orders based on the signals generated.

By implementing risk management protocols, such as stop-loss and take-profit orders, trade bots help to mitigate potential losses while maximizing profits, thus making them a popular choice for both novice and experienced traders alike.

Counter-Strike is a highly popular team-based first-person shooter game series that has captivated gamers since its inception. Players engage in intense matches, competing in various game modes, utilizing strategy and teamwork for victory. One of the more recent additions to the game includes the Operation Riptide Case, which introduced new skins and gameplay experiences for players to enjoy.

The Pros and Cons of Using Trade Bots in Cryptocurrency

Trade bots have become increasingly popular in the cryptocurrency market, offering various advantages for traders looking to enhance their strategies. One of the most significant pros is the ability to operate 24/7, allowing traders to capitalize on market fluctuations at any time, even when they are not actively monitoring their accounts. Additionally, trade bots can analyze massive amounts of data quickly, which can lead to more informed decision-making and improved trading performance. Furthermore, they can eliminate emotional trading by following programmed algorithms, which helps maintain discipline in volatile markets.

However, there are notable cons associated with using trade bots. Firstly, the reliance on automated systems can expose traders to risks if the bot encounters unforeseen market conditions or technical glitches. Many bots operate based on historical data, which does not guarantee future performance, leading to potential losses. Secondly, the complexity of some trade bots might require users to possess a certain level of technical knowledge, making them less accessible for novice traders. Lastly, security concerns also arise, as entrusting a bot with your capital means ensuring that it is secure from hacking or other vulnerabilities.

Can Trade Bots Really Improve Your Trading Performance?

In today's fast-paced financial markets, many traders are turning to technology for an edge, raising the question: Can trade bots really improve your trading performance? These automated systems use algorithms to analyze market data and execute trades at high speeds, often outperforming human traders. By eliminating emotional decision-making and adhering to tested strategies, trade bots can identify profitable opportunities that a human might overlook. This ability to process vast amounts of information in real-time can lead to enhanced accuracy and efficiency in trading operations.

However, the effectiveness of trade bots is not guaranteed and can depend on various factors, including market conditions and the quality of the algorithm itself. It's essential for traders to understand the limitations of these systems, as they may not adapt well to unexpected market changes or volatility. In addition, successful trading still requires a solid grasp of market fundamentals and ongoing strategy adjustments to maximize the benefits of using bots. Therefore, while trade bots can be a valuable tool, they should complement, not replace, a trader's overall strategy.